Why I turned down a six figure investment (for now)

Why I turned down six figure investment.

Here’s what I learnt about the Finance industry in the year I worked in a specific niche sector of it. Besides if you know me you know I love Fintech, read about that here.

Mostly, the big companies that you’ll see on TV adverts or the high-streets offering short term high cost credit – they are trying to do things right (believe it or not), and you should be encouraged by that! They exist because they strived & endeavored to do things better than all the charlatan’s during the Payday lender boom in the noughties, which is why they are still here trading. (just). There’s some good people in these companies! Trying to find that balance between running a business which makes money, (which they are entitled to do) and serve customers appropriately, they mostly work hard & honest to achieve this. There’s a definitive market need, and yet everyone opposes the companies trying to fill it which when you’re inside the sector is often surprising. The industry, its bodies be that the ICO, the FCA and other various parliamentary organisations constantly oppose, change the rules & marginalize these companies and make trading somewhat impossible.

The industry in its present state is somewhat fucked.

Old legacy systems are held together with hope & faith, with very little in the way of investment post the Payday loan crash and these companies grind and creak their way through serving the hundreds of thousands of customers they have. This is similar to a lot of companies and not limited to the Payday loans sector though and IT departments and technical teams constantly re-arrange, re-organise and shuffle around systems and websites to accommodate the constantly evolving and changing rules of CONC and other such legislation, trying their best to exist in a constantly changing world.

It’s pretty fucking impossible.

The industry itself & the view from the public isn’t always easy, seen as ‘a necessary evil’ at best and at worst ‘the devil incarnate’ companies have a hard time spending marketing dollar which actually yields meaningful results. Can you market a gold plated turd? I did a talk on how marketing anything is wrong when the emphasis is on Marketing and not the quality of the product, I’ll post a link to this.

Whether you’re putting a face on a fucking tangerine or stuffing a hamster into a plastic ball, the public see through this and all they want is a quality product – and yet marketing departments have the impossible task of not only trying to present an image that is succinct and to the point – meaningful and represents the industry in the best light, but also to accommodate the endless legal requirements dictating to the very last letter where things can and can’t go on paper, screens and spaces.

It’s a ballache slowly killing the very last companies on the market. Basically the industry is fucking itself.

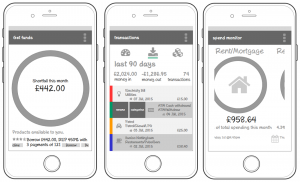

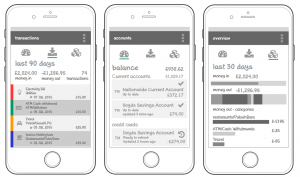

Much like the story-line from Terminator 2, ‘the future is not set, and there is no fate than that we make for ourselves’ however and the industry itself is in free fall. Technology start-ups have tried (somewhat unsuccessfully’ to ‘uberrise’ and disrupt the sector. Companies such as Wonga running Paylater services, (a payment option at check out of partnered e-commerce sites) and even myself (which brings this to the title of this blog post) whereby late last year I’d got all the way to funding stage of a mobile app which provided short term intelligent credit lines using big data to lend more intelligently than companies can at present. But I struggled to push it on.

After spending week’s prototyping, and months going through the minefield of what can and can’t be done in the industry, even queuing up a meeting with the Archbishop of Canterbury’s lot who wanted to take a peek, I decided to halt. I’d had my confidence knocked. Inside the industry I had my fair share of people telling me I couldn’t do what I was proposing, or that the technology wouldn’t work or that I’d not spent enough time in the industry to know what I was doing. ‘Mario you see things very simply’ was something I’d heard often. Maybe that was true.

All the time meanwhile I was back at my home in my little home office & workshop having built the fucking app, got it to BETA, and got a funding proposal. Partners were sometimes difficult to work with, and self-sabotage was rife in industry that I saw whilst I was in it, with people trying to trip up one another at every opportunity. I don’t blame them. People were protecting the industry they know and I’m sure had a lot more knowledge than me. With legacy teams who’d been in this game since day one, baulking though at how this type of proposed innovation could work I got a bit frustrated & spat my dummy out.

Like a lot of David Goliath type battles however, the one thing which worked in my favor was everyone under-estimated me. Having been in debt in my younger years and used short term loan companies from the coal face I was amazed at how few people who work in these companies actually have ever used the services themselves (or had to).

I knew what it was like from the customer’s point of view. Not because I’d done customer journey meetings or held insight workshops, because I had been a fucking customer and had been in debt & slowly crawled my way out.

I questioned how decisions about the industry could be made by a team of people rocking Mont Blanc pens, Gucci suits and Range Rovers in the car park. So the app I built served a specific need and after some feasibility studies, endless meetings and even trying to present internally I felt I had something. Besides, I’d only revealed about 30% of the whole idea, keeping some back for just me of course (because I wanted to dazzle in a Steve Jobs ‘just one more thing’ moment).

So why stop then?

Well my personal MO for this particular idea & project (excuse the grandiosity) is that the app, the platform & the product was genuinely intended to help people. People like me who needed it then and who may need it now. Typical web 2.0 start-up fair if you will, ‘do something good for the users & we’ll work out how to make money later’.

I want to be cuddled by a more established company in the market, maybe that means I’m not ready yet, we’ll see.

The future is not set.

So the future of the PDL industry is tough, a lot of uncertainty on the horizon. This may be a sector that slowly fucks itself from within, only time will tell. I do think disruption who are changing the rules of lending in the face of FCA regulation are going to ultimately win. I’m not suggesting being flippant with users, or trivializing something as important as lending money but things do need to change to serve the market.

I’m sat with some rapidly going-out-of-date code, several API’s & a couple of dev. sandboxes with a working solution, not quite being able to press delete yet.